January is always a good time to consider your existing tax situation. As we near the end of the 2021/22 tax year, in his latest article Independent Financial Adviser Joe McGovern gives his advice on how to make your tax year end a success.

A date which should be on everyone’s radar is the TAX YEAR END. This falls on 5th April every year and is the date on which the UK personal tax year ends, with the new tax year kicking off the following day (6th April).

A date which should be on everyone’s radar is the TAX YEAR END. This falls on 5th April every year and is the date on which the UK personal tax year ends, with the new tax year kicking off the following day (6th April).

The end of the tax year is important because it’s when personal tax rates and tax exemptions end for that year. The next day, these will reset to zero. If you have unused allowances for the current tax year, now is the perfect time to assess your tax situation and ensure that your allowances are used to their fullest.

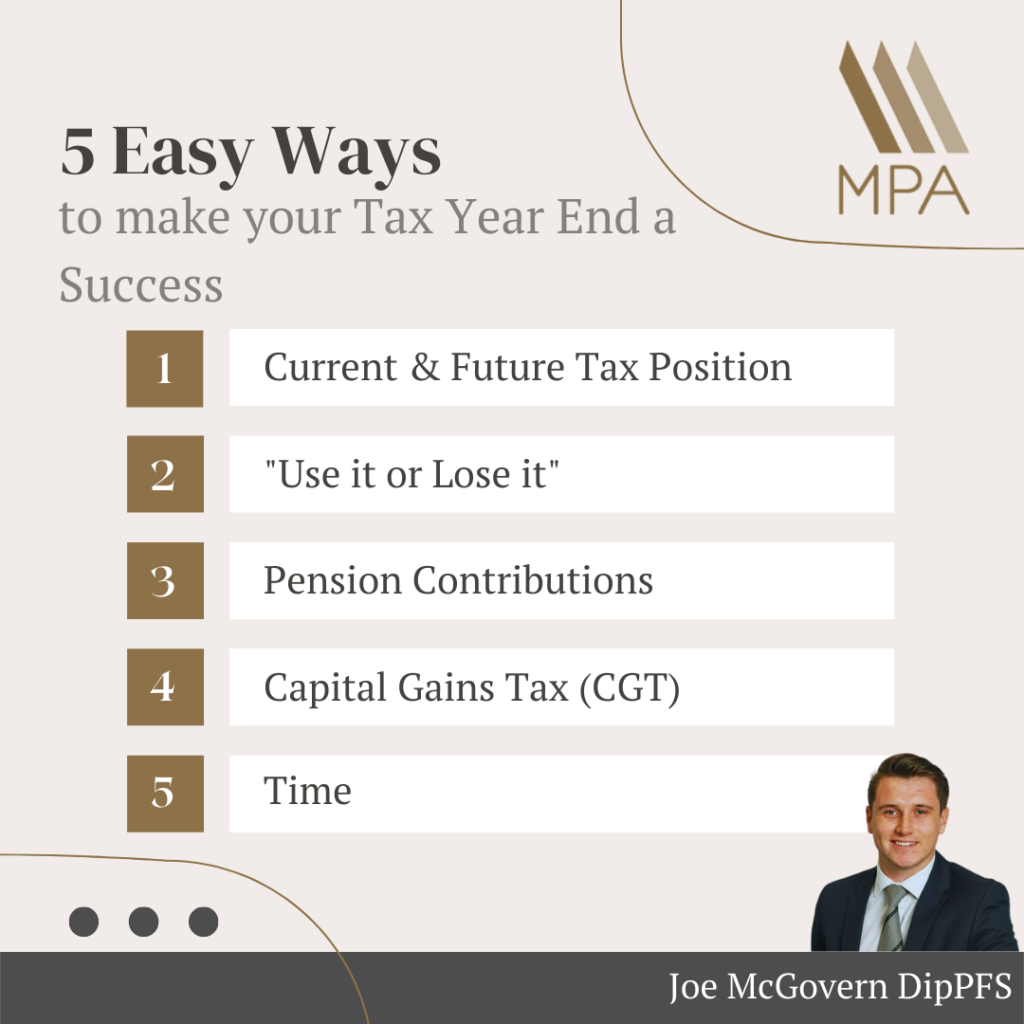

As the 2021/22 tax year draws to a close, we thought it would be easy to share five tips for a successful tax year end while taking advantage of any opportunities that may arise.

1. What is your current tax position and future plans?

January is a good time to consider your existing tax situation. For example, you may be close to exceeding a certain income tax rate, which means it is wise to wait until the start of a new tax year to withdraw money from your limited company or pension. To do this, you need a comprehensive view of all of your personal income earned so far this year – whether it’s wages, dividends or even profits from the sale of assets – that may qualify for Capital Gains Tax (CGT).

Once you understand your current position, look to plan into next year. Do you have any specific planned expenditures which would be: better funded from dividend income? Funded over two tax years? Paid from excess funds on deposit?

2. “Use it or Lose it” – Individual Savings Accounts (ISAs) ISAs and Junior ISA (JISA)

Everyone has an Individual Savings Account (ISA) allowance of £20,000, meaning the maximum you can save into a cash ISA, a stocks and shares ISA (or both) is £20,000 in any given tax year. Gains and income within ISA are free from any Income Tax or Capital Gains Tax.

“Use it or Lose it” is important, because you can’t carry this allowance into the next tax year. If you are in a position to invest money before the end of the tax year, maximising your ISA allowance is a tax efficient way to save for your future.

A JISA is the same as an ISA but for those under 18. A maximum of £9,000 can be contributed which can help save for your children and grandchildren until they turn 18. Just like your personal ISA, this allowance does not roll over, which is why it can be beneficial to use it.

Contributing to JISA’s on children and grandchildren’s behalf can also aid with Inheritance Tax planning.

3. Pension Contributions

Every UK individual has an Annual Allowance (£40,000 21/22 tax year). The Annual Allowance is the maximum amount you can put into a pension pot (including employer pension contributions and basic tax relief) in a single tax year before tax applies. When it comes to pensions, there are two main things to think about as the end of the tax year approaches:

- Make the most out of your allowances. If you have a large amount of this allowance left at the end of the tax year, you may want to make a lump sum contribution to your pension plan.

- Unlike an ISA, unused allowances may be rolled over from previous tax years meaning you may be able to pay more than £40,000 in the current tax year. It is best to consult a financial advisor before making any changes to the way your pension is organised.

Note: Personal contributions attract tax relief at your marginal rate of income tax (basic rate immediately). Employer contributions are deemed an allowable business expense in terms of corporation tax.

4. Capital Gains Tax (CGT)

CGT is the tax you pay on the amount of profit you make from the sale of an asset, whether it’s property (other than your primary residence), your business, stocks and shares, jewellery, or art.

For example, let’s say you bought a painting for £40,000 and sold it for £60,000. The gain is £20,000 and you may be required to pay CGT. The good news is that we all have an annual capital gains tax allowance (£12,300 or £24,600 for married/civil partnerships) so if you haven’t used any allowance, you’ll only have to pay CGT on the £7,700 above the CGT allowance (£20,000 – £12,300).

Note: Capital Losses can be carried forward indefinitely against gains of future years.

5. Time

The final tip for a successful tax year end is time. Give yourself enough time before the end of the tax year to plan and ensure everything is in place. Rushing around trying to get things in place on the 4th April is no good for anyone.

With a few months to go, completing the work now will mean it is one less thing to worry about.

It may be a cliche saying, but when it comes to the Tax Year End, “Fail to prepare, prepare to fail” applies. The key to a successful tax year end is a clear understanding of your existing tax obligations.

If you have any questions or wish to engage with any of the tips above, please contact your Adviser at MPA.