After the mega giveaway in the mini budget on Friday 23rd September 2022, it is safe to say that the various investment markets have not reacted favourably to the raft of tax changes and dash for growth that Kwasi Kwarteng announced.

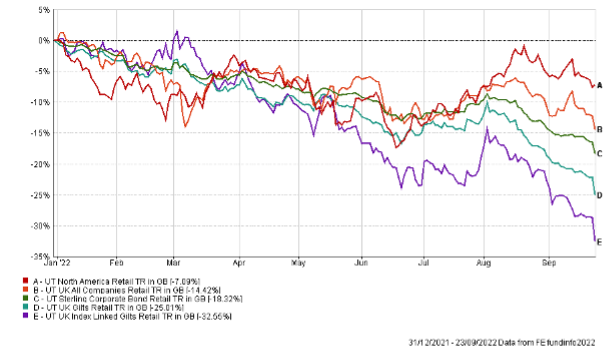

The bond markets have fallen, alongside the pound and the UK Stockmarket has also suffered and is now below 7,000. Below is a chart of the main sector averages since the start of the year. UK Index Linked Gilts have fallen over -30% and UK Gilts -25% and these are tow of the safest places you can invest in normal times and you can see their sharp drops since Friday’s announcement.

So how does this affect our normal portfolios?

Well, a balanced investor will have around 40% in safer bond and gilt investments and as you can see they have had a rough time this year. Equities have fallen across the board but not as much as lower risk bonds.

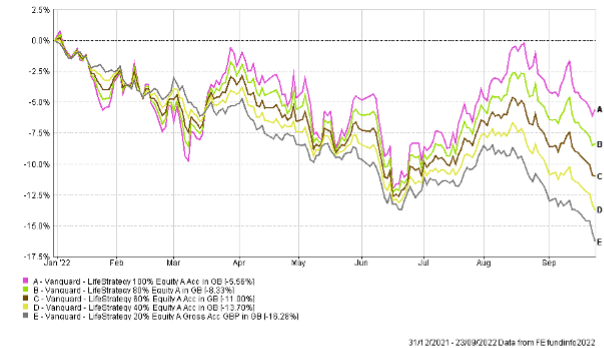

The next chart shows the five Vanguard Lifestrategy Portfolios since the start of the year. They start at 20% Equity with the rest in bonds rising to 100% equity. The risk profiles are a 3 to a 7 and we can see that the lower risk portfolios (20% equity) have fallen the furthest since the start of the year which is counter intuitive to what you would normally expect. However, with rising interest rates and rising inflation the bond section is adversely affected. The 100% equity portfolio has fallen -5.5% while the lower risk 20% equity is down -16%.

It appears that we are getting to the bottom of the fall in bond prices and we will hopefully see these recover over the next six months.

So, as usual, it’s a case of holding on and waiting for the rebound. If you are invested in cash these rates are starting to look attractive to buy at the moment.

If you have any questions or concerns, speak to your adviser.

Phil J McGovern FPFS

After the mega giveaway in the mini budget on Friday 23rd September 2022, it is safe to say that the various investment markets have not reacted favourably to the raft of tax changes and dash for growth that Kwasi Kwarteng announced.

The bond markets have fallen, alongside the pound and the UK Stockmarket has also suffered and is now below 7,000. Below is a chart of the main sector averages since the start of the year. UK Index Linked Gilts have fallen over -30% and UK Gilts -25% and these are tow of the safest places you can invest in normal times and you can see their sharp drops since Friday’s announcement.

So how does this affect our normal portfolios?

Well, a balanced investor will have around 40% in safer bond and gilt investments and as you can see they have had a rough time this year. Equities have fallen across the board but not as much as lower risk bonds.

The next chart shows the five Vanguard Lifestrategy Portfolios since the start of the year. They start at 20% Equity with the rest in bonds rising to 100% equity. The risk profiles are a 3 to a 7 and we can see that the lower risk portfolios (20% equity) have fallen the furthest since the start of the year which is counter intuitive to what you would normally expect. However, with rising interest rates and rising inflation the bond section is adversely affected. The 100% equity portfolio has fallen -5.5% while the lower risk 20% equity is down -16%.

It appears that we are getting to the bottom of the fall in bond prices and we will hopefully see these recover over the next six months.

So, as usual, it’s a case of holding on and waiting for the rebound. If you are invested in cash these rates are starting to look attractive to buy at the moment.

If you have any questions or concerns, speak to your adviser.

Phil J McGovern FPFS