Have we seen the end of the market in Final Salary or Defined Benefit (DB) Pension Transfers? Probably yes and its all down to rising interest rates.

The biggest contributor to the calculation of a DB transfer are interest rates. To be precise that means gilt yields as they are used in 3 stages of the calculation of interest rates. If interest rates rise, as they have, you need a smaller fund to generate the same income and that’s why transfers have fallen. So, if the DB Transfer was projecting an annual pension income of £10,000 pa and the interest rate quoted was 1.5% then you would need a pot of money of £666,666 to generate that level of income. If interest rates rise to 3.5% then you would need a pot of £285,714 which is a massive fall of -57% on the transfer value.

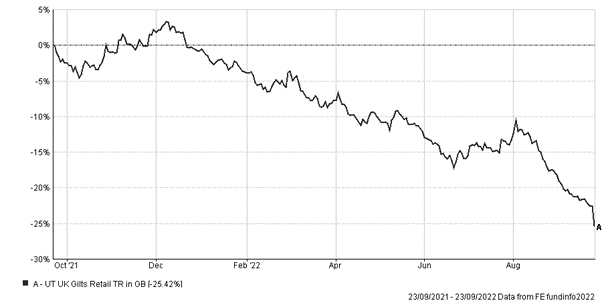

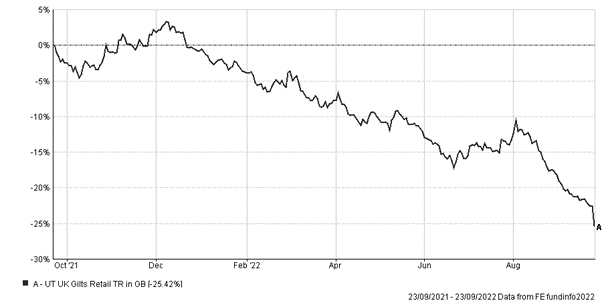

Above is a graph of the Gilt Index over 1 year which shows the capital value of gilts have fallen by -25%. This is directly correlated to what has happened to transfer values. XPS Pensions run a Transfer Index as an average figure of transfer values across dozens of DB Pension Schemes. The Index is based on a DB Pension of £10,000 for a 64 year old with normal increases factored in. The Index peaked in December 2021 at £270,000 and it is currently at £190,000 which is a fall of -29% over the year to date and shows why transfers will pretty much stop as an attractive option. The fall in transfer values also mirrors closely the Gilt Index above.

Every Cloud

One of the benefits of rising interest rates are annuity rates. Annuities generate a guaranteed income for life and the rate is dependent on the income from gilts. So, as the interest rates rise so do income from gilts and we are getting to a place where you will be able to exchange some or all of a DB transfer for a guaranteed income for life that could be substantially higher than the guaranteed income you gave up when you transferred out of the DB pension.

Speaking to an adviser today they have just secured an annuity rate of 6.9% for a 68 year old which would mean a £10,000 pa income would have needed a fund of £144,927 with which to buy it.

Anyway, if you want further information speak to your adviser.

Phil J McGovern FPFS

The information in this briefing is not intended as advice to any individual but is a brief commentary of the current situation. Figures quoted are correct at going to press and you should obtain an individual quote from a qualified adviser before making any decisions on your pension. Past performance is no guide to the future and the value of your investments and the income from it can rise and fall in line with market conditions.