A tale of two cities – Defying the Brexit gloom.

‘It was the best of times, it was the worst of times, it was the age of wisdom, it was the age of foolishness’.

If you have as much as glanced the news since the results of the referendum last year, you might have been lead to believe that if and when we leave the EU, London (and presumably the rest of the UK) will crumble into the sea along with any and all investments based here. This pessimistic view may have sent many into a panic worrying about the future of Brexit Britain, but is this really the case for the UK?

Despite the doom and gloom there remains the promise of business to come. In fact there are already signs of investment into the UK, one example if investment into UK property by foreign companies. Despite scaremongering, Deutsche Asset Management (AM) has completed a £310m deal with M&G Real Estate for London property. The two units in London were bought for AM’s German open-ended real estate funds which have assets totalling around £42bn. The properties, located behind the Tate Modern in Southbank consist of 38,500 sqm of office space spread over 9 floors and are already fully let with RBS occupying most of the space.

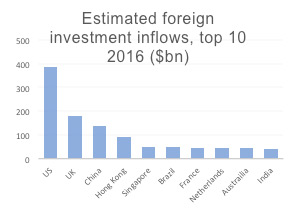

This deal isn’t a fluke either. Despite a negative outlook on Britain, in the wake of the vote, the amount of foreign investment into the UK surged to $179bn in 2016 This was the second highest level in the world behind the US and a 6-fold increase on 2015. This means that the UK attracted more foreign investment in 2016 than France, Brazil and the Netherlands combined (a total of only $150bn). These figures, collected by the United Nations Conference on Trade and Development (UNCTAD) show that despite general falls in foreign investment in the EU and North America as a whole, the UK attracted huge foreign investment, including a deal of over $100m for SABMiller which took place in September. Although these deals were in the making pre-Brexit, the fact that they went ahead speaks volumes about the positivity that still remains towards the UK in the wake of the EU referendum.

In addition to this Qatar has recently said that it would pump an additional £5bn into the UK to invest in infrastructure, this builds on the fact that Qataris now own three times more London property than the Queen. Currency changes caused by the referendum no doubt encouraged foreign investors trying to capitalise on a weaker pound with a surge of investment from Asia who has now displaced Europe as the biggest source of foreign investment into the UK.

Figures like these can often get lost in the doom and gloom of the Brexit blues, but highlight an important fact; the UK is still an attractive investment. It is not unfair to say that when looking at stories about London it often looks like a tale of two cities – although many may say we are doomed, there’s always more to the story if you look in the right places.