Needless to say that the events of the last several months have caused large scale disruptions to the lives of everyone and will no doubt fundamentally change our outlook on many issues.

Possibly one of the few beneficiaries from the enforcement of global lockdowns across the world could be considered to be the environment.

Reportedly, air quality has improved due to the fewer cars on the road, the skies are free from the condensation trails left by aircrafts, while in Italy, the Venice canals have never looked clearer, as motorised boats and giant cruise ships have disappeared.

All this has led to many asking whether this COVID-19 induced market sell-off will have changed the outlook for ethical, social & governance (ESG) investing.

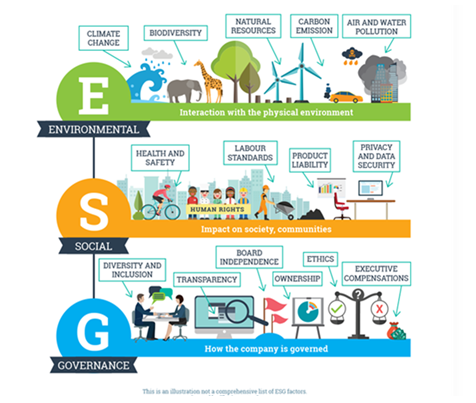

What is ESG Investing? Quite simply, putting money into assets where environmental, social and governance issues are being measured and compared and these are the key drivers of business decisions.

Will you, our clients, having gone through the recent upheavals in society and the environment become more conscious of this when making investment decisions in the future?

Will there be recognition that investing based on ESG principles in market downturns is a possible way to protect capital by mitigating the new type of risks that we have seen and have had such an impact on the market?

Over recent months ESG-orientated companies have indeed appeared to more resilient, even though we are only looking at a short time frame and we will have to continue to monitor this.

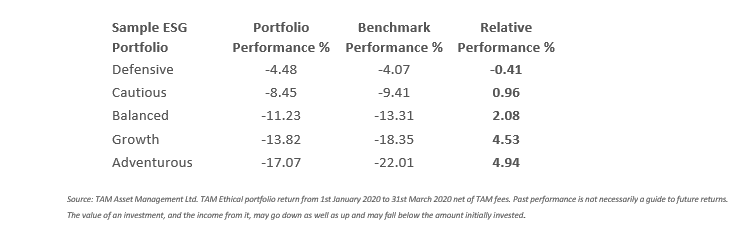

Many ESG funds held within portfolios have continued to have reasonable relative performance during this heavy market sell-off, losing less than their benchmark and peers:

Realistically what has been highlighted, as always, is the importance of investing in quality companies, which is at the centre of ESG-focused strategies. Of course that is said in general, not just in these type of strategies, but more and more ESG is being used as a measure of the quality of a business and whether it is held in a portfolio.

Over the month of March, where we saw the heaviest market falls, the US stock market fell in the region of 12% as measured by the S&P 500 index, versus the declines of the FTSE All Share and MSCI Europe indexes of around 15% and 14%, respectively. This relative outperformance of the US stock market is being ascribed to its quality bias.

Quality is assessed in several ways, relating to the soundness of a company’s balance sheet, how stretched it is in terms of leverage, and whether it has a competitive advantage in its products or services that can drive long-term returns. Companies performing well on ESG issues tend to tick many of these boxes.

Of course, we cannot claim that ESG stocks are immune from market sell-offs, and they have indeed seen negative returns over the last few months. The difference perhaps is that companies adopting ESG principle by their very nature have a long-term strategy which should still be intact, meaning there is scope for strong rebounds once the short-term sentiment fades and markets return to looking at fundamentals.

ESG investing was already starting to be a significant factor in the investment landscape, even before the coronavirus outbreak, which will perhaps serve to accelerate the pace of this transformation.

The virus has brought to light not only issues concerning the direct impact on the environment, part of the ‘E’ in ESG but there has also been a strong emphasis on employee health and safety, general labour practices relating to the ‘S’, as well matters surrounding longer term planning, market positioning, flexibility and disaster recovery strategy concerning the ‘G’.

When we eventually come out the other side of this historic period for markets, we believe quality companies who have continued to focus on adhering to sound ESG principles may well be considered by many as key and invested in accordingly.