Don’t get me wrong this year has been extremely tough in investment markets across the globe. Inflation is the biggest issue along with supply chain issues, rising interest rates and certainly rising energy costs. With this backdrop investment portfolios have taken a bit of a pounding.

Most portfolios have a blend of equities and bonds. Normally when equities rise bonds are fairly flat and when bonds rise equities are fairly flat. This year however, equities have fallen sharply but due to rising interest rates bond prices have fallen sharply also.

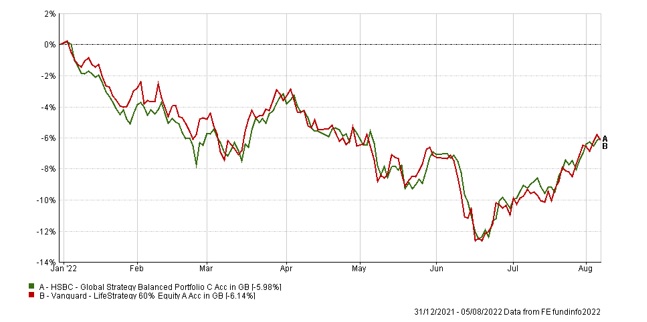

If we look at two of our most popular portfolios, Vanguard Lifestrategy 60% Equity and HSBC Global Strategy Balanced (both risk rating of 5/10) in the following chart since the start of the year you can see its been somewhat challenging.

At one point this year they were down around -12% since January 1st but have since bounced back a little and are down -6% at the moment.

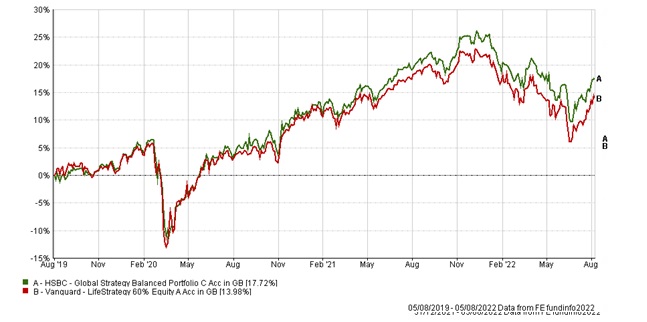

However, if we look at the 3 year figures, we can see its not all doom and gloom. Also consider the fact that during the last 3 years we had the massive downturn in March 2020 due to the pandemic and the recovery afterwards.

The second chart shows that HSBC went up by nearly 18% and Vanguard by nearly 14%. As we generally target 5% a year for a 5 out of 10 risk profile we can see that even with 2020 and this year they are still pretty much on track to achieve what they should realistically achieve.

So, my message to you is that you should stay invested, and investments should be viewed as a medium to long term investment and its time in the markets that will be the main driver of investment returns in the future.

As always at MPA we will continually review the portfolios we recommend based on price and performance but remember no investments are guaranteed and past performance is no guide to future returns.

Phil J McGovern FPFS

Managing Director

08/08/2022