Yesterday we had Boris announcing more and more measures, both monetary and practical. They have said they will do whatever it takes. Markets were positive yesterday and up as I write today. (9.21am)

I hear Martin Lewis was offering practical advice on TV last night when worried investors were writing in saying they had lost thousands on their investments. As he pointed out you only lose when you cash in.

I read an interesting article by Richard Woolnough who is a fund manager with M&G and manages their Corporate Bond and Optimal Income funds. He was brilliant in the recovery after the Financial Crisis so is worth listening to.

He stated that ‘the coming recession will only last 3 months and will not end in a gradual recovery, but with the biggest ever jump in GDP on a weekly and monthly basis’.

‘Woolnough said this is the most certain recession he has ever seen, due to the noticeable drop off in daily activity all around us: all discretionary spending has been drastically reduced, with the most expensive type – travel and tourism – cut the most.’

The manager said the resulting bounce back will be enormous. Thus the economic data will show a rapid rebound: it will not be V or U shaped rather it will look like I’

Lets hope so. He backs it up with various charts and he manages over £20bn so he is worth listening to. I am not saying he will be proved right but he comes up with some cogent arguments to substantiate it.

Prudential PruFund Range

As expected the Prudential has cut the share price of its PruFund Growth in the onshore investment bond by -9.54%. This follows on from the cut to pensions on Tuesday.

They have applied similar cuts to International Investment Bonds and they have also cut the PruFund Cautious Portfolio Series E in their won pension by -9.78%.

They still haven’t altered the PruFund Cautious in the Trustee Investment Plan (bought through a SIPP) or Cautious in an Investment Bond; but it can only be time.

Pound Dollar

The pound is at a 35 year low against the dollar and is currently at $1.18 to the pound. One beneficiary of this in pound terms are overseas investments. When the pound weakens they increase and one proxy of this is the Fundsmith Equity Fund that has 65% in US companies. Since Monday it has increased by 5% so that it is showing a loss on the year of -10.20%. This bounceback is partly due to the fall in the pound as stockmarkets have not bounced back that much.

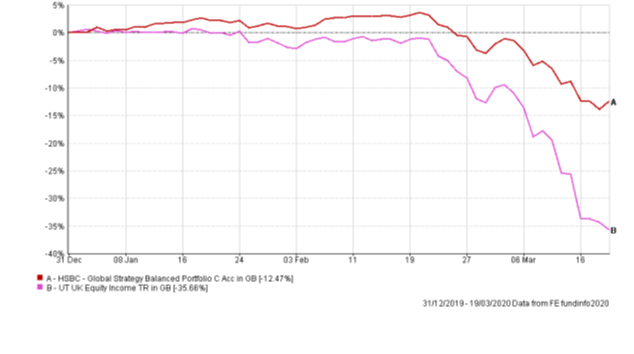

Below is a chart of UK Equity Income sector against HSBC Global Strategy Balanced. UK Equity Income is a 7 out of 10 and the HSBC Portfolio is a 5 out of 10 and has about 60% in global equities.

This is year to date and as you can see we have seen an uptick in HSBC, which I think is due to the weakening pound. I also think it shows how much the UK has oversold as the US is only down -19%.

Anyway, the FTSE 100 is up 3.79% today (10.21 am) so hopefully the measures announced will calm the markets.

Have a good weekend, and stay safe.

Please contact your adviser if you have any issues.

Phil J McGovern FPFS