I had a meeting with a client last week who commented that the PruFund ‘defies gravity’. I explained it doesn’t, but so far it hadn’t been affected by the huge losses on the stockmarkets. I also explained that this is not sustainable but lets wait and see.

Well, last night we had our answer as they announced some quite severe reductions in the PruFund Growth Fund.

In the Prudential ISA, Trustee Investment Plan (TIP) and the Flexible Retirement Plan they have reduced the share price of the fund by -11.99% for the PruFund Growth Fund only.

Currently the PruFund Cautious Fund is not affected.

The Trustee Investment Plan is the policy where we buy the fund within a SIPP and is the one we have used the most in the last few years.

Underneath is an explanation of how the PruFund works on a daily basis

Every day, for each PruFund fund, we monitor two things: • the unit price, which we refer to as the “smoothed price”, which normally increases each day by the EGR, and • the “unsmoothed price”, which is the value of the underlying fund divided by the total number of units. Every day, the smoothing process checks the gap between the smoothed price and the unsmoothed price. For this purpose, the gap is calculated using both: 1 the unsmoothed price and, 2 a five-working-day rolling average of the unsmoothed price. If the gap is ever equal to or more than the Daily Smoothing Limit (a specified limit, shown as a percentage of the smoothed price, that we may choose to vary from time to time and that may differ across the range of PruFund funds), we’ll adjust the smoothed price straight away, to reduce the gap to the value of the Gap After Adjustment for the relevant fund.

(EGR is Expected Growth Rate)

For a lot of clients we have been using the PruFund as a dampener of volatility to smooth the ups and downs of daily moves in stock markets but the latest crisis has changed that for now.

In 2008, at the height of the financial crisis the fund dropped -16% so this is not unheard of, and when the markets bounce back, this will be reflected in an increase of the share price.

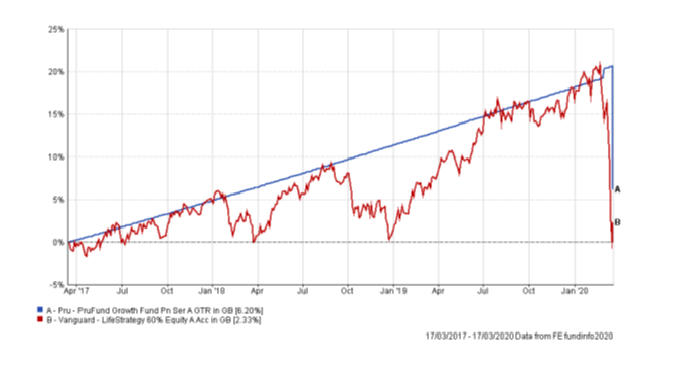

Below is a chart of the PruFund Growth fund against the Vanguard Lifestrategy 60% Equity Fund. They are both a 5 out of 10 on the MPA Risk Profile and you can see the difference over a 3 year period.

Shocking is not too strong a word, but if we have learnt anything from the Financial Crisis of 2008 it is that with some Government intervention, markets will recover as we in the UK have sold off far too much and hence why I think it will rebound fairly quickly.

I read in the Daily Telegraph today an article by Tom Stevenson which says ‘Why this is a once in a generation buying opportunity’. ‘In five years we will look back on March 2020 as one of the best periods to buy in the market’.

China is recovering and pollution levels are getting back to what they were before they had their shut down which means that people are moving about and factories are starting to get producing again. Coal consumption in March, in China is down 20% from a normal March but is up 25% from February. Indicators that the economy is starting to move again. Italy’s, death rate is starting to slow which is another positive sign.

Lets hold tight and sit this out for now.

Keep healthy and safe.

Phil J McGovern FPFS