This article is correct as of the 4th March 2020.

As you may be aware there has been an economic shock over the last few weeks to the spread of COVID-19 on the markets.

Things have begun to calm a little but if you are concerned, I hope the following helps understand our view for the majority of clients.

Having consulted with our investment partners the consensus is that there will be an impact on global growth in 2020 but the initial shock to markets will be temporary as the virus is brought under control and measures are put in place to reduce its impact.

The effect on markets will depend on the length of time it takes for the controls to come into effect and the spread across the globe but the view is markets will start to get back on track in quarter 2 .

We have already seen that governments are taking important measures to control the spread and manage the infection rates.

The USA have just cut 0.5% off their base rate and the UK and Europe is likely to follow to ease the economic burden.

Factories in China are returning to work and the rate of infection has slowed down.

There has been a reduction in trade tension between China and USA after phase 1 of their trade deal.

Although you cannot replicate the impact that a global health issue has on markets if we look at the history of SARS it may indicate what may happen. In November 2002 SARS was identified and people infected was 8,000 in China with 774 deaths. The infections subsided in May of 2003. Markets recovered to pre infection levels once the virus was understood and it was known how to control it.

It’s important that you remember you are investing for the longer term and it is felt that the global recovery that started at the back end of 2019 is delayed rather than derailed. History shows that in times of uncertainty when people are concerned it’s a time to hold your nerve as markets do recover.

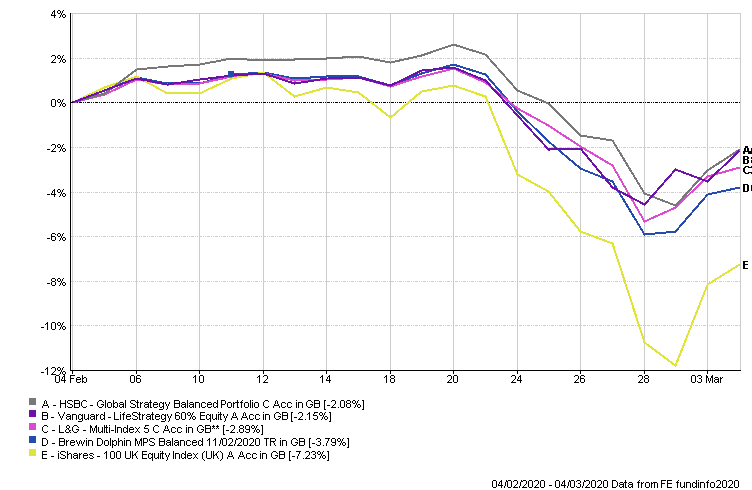

We look to diversify your portfolio so you are not reliant on one asset class or one area of the world. By offering a blend of funds between active funds that offer value to get the most of the upside with lower cost funds that track various markets and managed portfolio services offering wide diversification we aim to cushion the down side but position it so when the confidence returns to the markets you will benefit from the up side.

Your appetite for risk will depend on the impact on your fund in the short term and how much you participate in the recovery when it happens and markets stabilise.

There are 94,072 reported cases which has resulted in 3,218 deaths around the world. The death rate is officially over 3% but is estimated to at around 1%-1.5% as a lot of people will have a mild form of this infection without it being recorded.

As of yesterday 87 new cases were reported in the UK.

Italy has either cancelled or restricted sports events to closed doors.

Below is a chart of 1 months performance of our best selling Risk 5 portfolios against the FTSE 100 index in yellow. HSBC has fallen -2.08% and the FTSE 100 by -7.23%.

The DNA of the virus has been identified and work is progressing for a vaccine.

It is far less dangerous than SARS which had a fatality rate of just under 10%.

We will keep you updated on the progress and impact of markets and the opportunities it may offer you in the longer term.

Should you have any questions in the meantime, please do not hesitate to contact your adviser.

Remember past performance is no guide to future returns and your investment may fall as well as rise in line with market conditions.