Today we turn the spotlight on one of our favourite individual funds we have used over the last few years; Fundsmith Equity.

Fundsmith Equity was set up in 2010 by Terry Smith as a global equity fund that has a very simple aim. It will invest in global equities on a long term basis and will not adopt short term trading strategies.

The Company’s stringent investment criteria are to invest in:

- High quality businesses that can sustain a high return on capital

- Businesses whose advantages are difficult to replicate

- Businesses who do not borrow heavily to generate returns

- Businesses resilient to change particularly technological innovation

- Businesses whose valuation is considered to be attractive

With such a strict criteria, there are not many global companies that fit and so the shares in the fund are limited to between 20-30 stock which is very low for a fund of this type.

Currently the fund has 27 shares in it with the largest being Paypal, Microsoft, Facebook, Pepsico, VISA and Estee Lauder to name a few.

Average size of the companies (by Market capitalisation) is £106.4bn and the average date that the companies were founded is 1927. So we are looking at massive companies with a seriously long history of generating profits and share price increase.

Since launch the fund has grown to £18.6bn in size without a salesforce or any great marketing campaign and has achieved its success mainly by word of mouth.

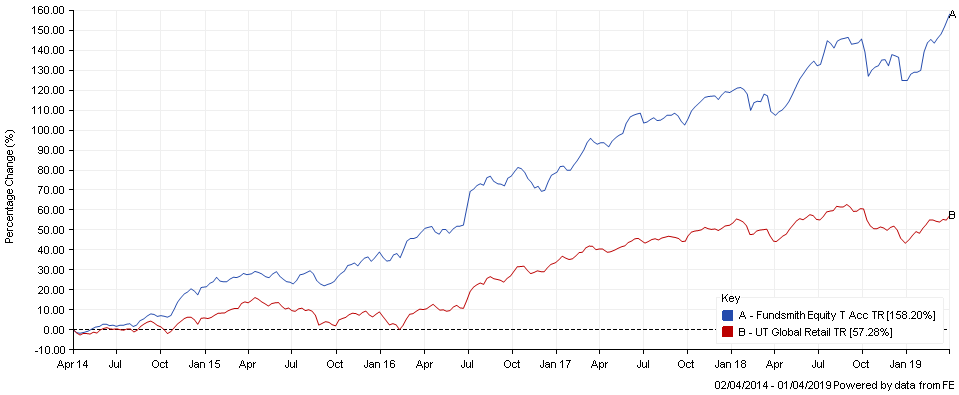

Below is the performance over 5 years against its sector average;

Since launch it has averaged 18.80% pa (to 29th March 2019)

Due to the strict nature of the investment criteria, 65% of the holdings are in the USA with the rest split between UK and Europe.

Due to its global nature it is an 8 out of 10 on the MPA risk scale, which is high.

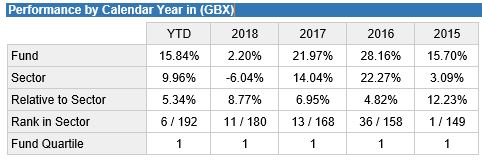

As you can see from the table below its performance is spectacular.

Source: FE Analytics 2.4.19

MPA Opinion

Although we are great believers in having a portfolio with a balanced asset allocation it sometimes pays to have a small holding in a fund that can help drive overall returns upwards.

Some of our best performing portfolios with Brewin Dolphin and LGT Vestra have Fundsmith as part of the portfolio and we have some clients who have an extra slice of their money in this fund.

Its certainly been the best performing fund we have used over the last few years.

Phil J McGovern FPFS

Chartered Financial Planner

2nd April 2019

However, past performance is no guide to the future and the value of your investment can fall as well as rise in line with market conditions.

The information in this newsletter does not and should not be construed as advice. If you are interested in investing in this or any fund you should speak to your qualified adviser first to make sure it matches your attitude to investment risk and capacity for loss.