Following its quarterly review, PruFund has announced that the Expected Growth Rate (EGR) for its range of funds will remain unchanged this quarter end (25th August).

PruFund has not applied any Unit Price Adjustments (UPAs) this quarter but has instead applied a Unit Price Reset (UPR), resetting the ‘smoothed price’ to the ‘unsmoothed price’. The adjusted smooth price is now expected to grow in line with the EGR and it is good news for MPA clients.

This is the first time since the fund was established that a UPR has been applied. This is because markets have recovered more quickly than anticipated since the start of the pandemic in early 2020.

Phil McGovern, MPA Managing Director comments: “Essentially, we are seeing PruFund performing a little bit of catch up in performing the UPR. As market conditions have improved, the unsmoothed price has performed better than the smoothed price. The UPR has adjusted the smoothed price to the higher unsmoothed price to reflect the current conditions.”

“Our clients are now benefitting from the rise in the stock market and it has resulted in a 5.66% increase in share price. PruFund Growth is now at 5.66% for a pension and 5.06% for the onshore bond. The value of our clients’ investments has, in some cases, risen by £20,000 – £30,000 overnight and our total funds under management has risen by £3 million.”

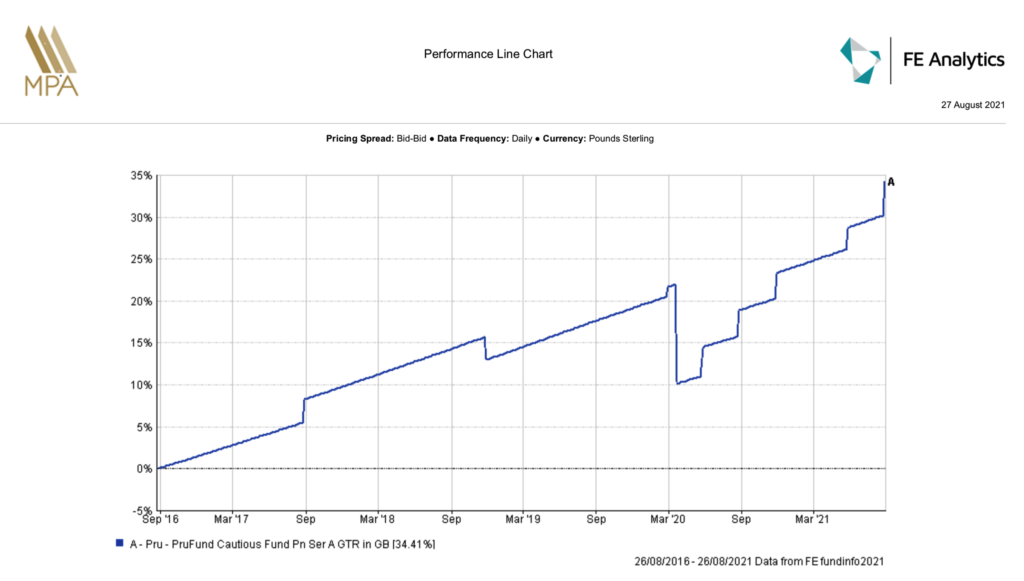

PruFund 5 Year Performance Chart

The PruFund range of funds aim to grow investors’ money over the medium to long term (5-10 years or more) and therefore use an established ‘smoothing process’ to protect investors from the extreme short-term ups and downs of direct stock market investment. This is designed to give a more stable rate of growth than investors would get if directly exposed to daily changes in the market.

The idea is that while investors won’t benefit from the full upside of any potential stock market rises, they won’t suffer from the full effects of any downsides either.

If you would like any further information, please speak to your financial adviser. If you are not an MPA client and would like to discuss your financial future, please get in touch.