At its recent quarterly update on its PruFund range, Prudential has adjusted its Unit Price. The fund is our largest holding for clients and on our Best Buy List, so here, our MD Phil McGovern provides an update on what this means for PruFund investors.

Prudential have had their quarterly update on the PruFund range of funds and disappointingly they have applied a negative Unit Price Adjustment across a range of their funds. In simple terms they have reduced the share price of the smoothed fund so that it better reflects the value of the underlying unsmoothed fund that delivers the returns.

Overall, if you have PruFund Growth you would have seen the value of your holding fall. If you hold PruFund Cautious then you would have seen the value of your holding either remain the same or fall.

If you hold PruFund Growth in a SIPP with AJ Bell for instance (or other SIPPs) or in Prudentials own Retirement Account or in an ISA the share price fell -2.84%. If you hold PruFund Cautious in a SIPP or Retirement Account there was no change to the share price.

If you hold investments in the Prudential Onshore Investment Bond Growth fell -3.36% and Cautious -2.63% respectively.

Although mighty disappointing this reflects the general state of investment markets from last year through to this. Equity markets have picked up at the start of the year to repair some of the damage of 2022 but bond markets are still fairly fragile; there has been some recovery but not enough yet. Inflation is starting to fall slowly but not at the levels the markets thought they would which will mean higher interest rates for longer unless the Bank of England get it under control.

The Expected Growth Rates (EGR) which is the rate at which the PruFund goes up each year have been revised slightly upwards due to the Prudentials view of long term investment returns. (15 years)

In the pension, PruFund Growths EGR is 7.7% pa and Cautious is 7.0% (up from 7.3% and 6.3% respectively). The onshore bonds PruFund Growth is now 6.4%.

These rates are based on 15 year forecasts and are reviewed every quarter for the majority of the PruFund range but monthly for some others.

The PruFund range is still our largest holding for clients with c£70M held in these funds which have generally been a fantastic investment over the past few years especially with all the volatility we have experienced. I will still have no hesitation to recommend it today for a long term investment as part of a wider portfolio.

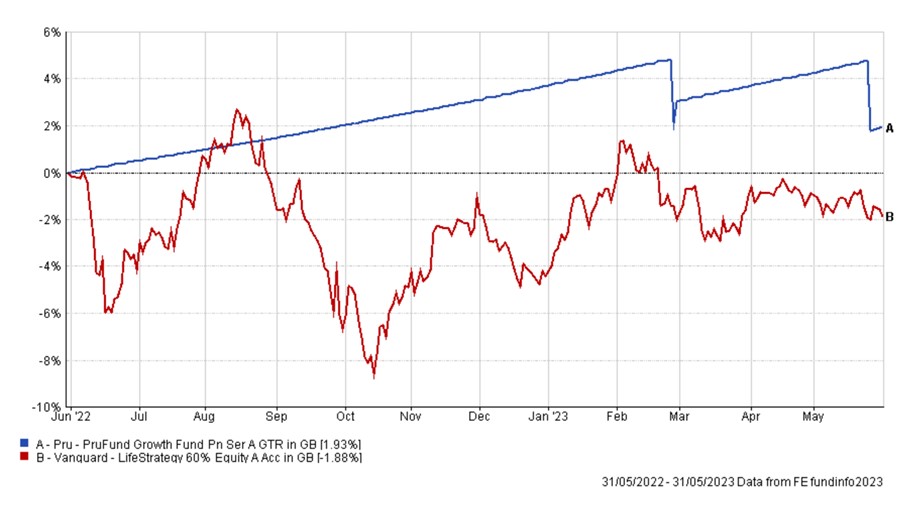

Below are a couple of charts that show how it has done against one of its peers over the short and longer term.

Chart 1 – above shows PruFund Growth in a pension or ISA versus Vanguard Lifestrategy 60% Equity over 1 year. Vanguard is one of the biggest selling funds of its type in the industry and they are both a risk profile 5 out of 10.

So, even with the two reductions this year PruFund Growth is still +2% higher than Vanguard over 1 year.

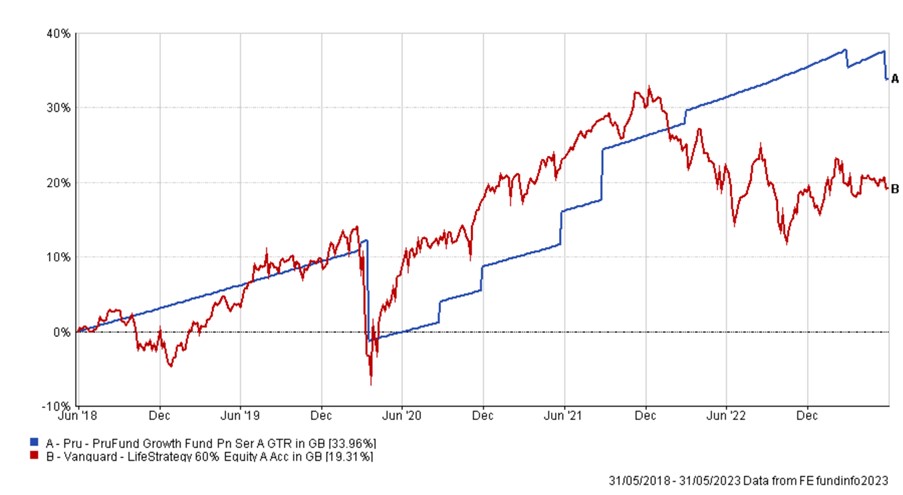

Below in Chart 2 I have looked over 5 years to see the difference.

Over 5 years PruFund Growth is +14% above Vanguard.

The PruFund range operates a smoothed fund, which is the one you as clients invest in, and an unsmoothed fund, which is the fund in the background that generates the returns for the smoothed fund. If the two get out of kilter then Prudential apply a UPA, either up or down. It is not a discretionary move but an automated one. If on a valuation date the difference is more than 5% then they have to move the smoothed price to within 2.5% of the unsmoothed price. So, if there is ever a movement on the UPA it will usually be in 2.5% chunks at least. It the difference ever gets wider than 10% they can move the smoothed fund share price any time. That’s what happened in 2020 at the peak of Covid.

However, overall PruFund has delivered over short and long term but we will keep monitoring its performance to see that it still matches our brief and forms part of our Bet Buy List.

For further information on how PruFund works please contact your current Adviser to discuss how it works for you.

Remember past performance is no guide to the future and the value of your investments can fall as well as rise in line with market conditions.

Phil J McGovern FPFS

Managing Director