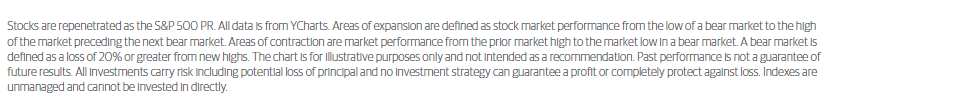

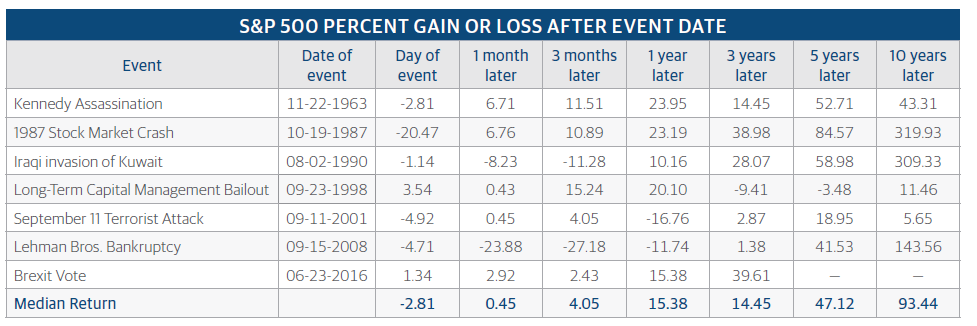

Unexpected world events which have sudden, material impacts on the financial markets are nothing new. It is important to keep uncertain headlines and volatile moves in perspective by looking back at the equity market’s performance during and after similarly disruptive past events.

While at the time it can feel like a crisis is rapidly unfolding and the smart course of action is to move out of the way, history reveals this would have had a devastating effect on an investor’s long-term returns.

Each one of the historical events and epidemics in the tables below took many by surprise and undoubtedly resulted in some investors selling at precisely the wrong time.

With this in mind, it is best to approach the markets with the knowledge that unpredictable events happen from time to time. The only way to counteract the impact of these rare market shocks is to build an investment philosophy firmly rooted in proper diversification and asset allocation. Then predicting these events becomes largely unnecessary, as a properly diversified portfolio is equipped to face periods of market turmoil while still being positioned to capture strong, long-term, risk-adjusted returns.

S&P 500 performance after macro and epidemic events

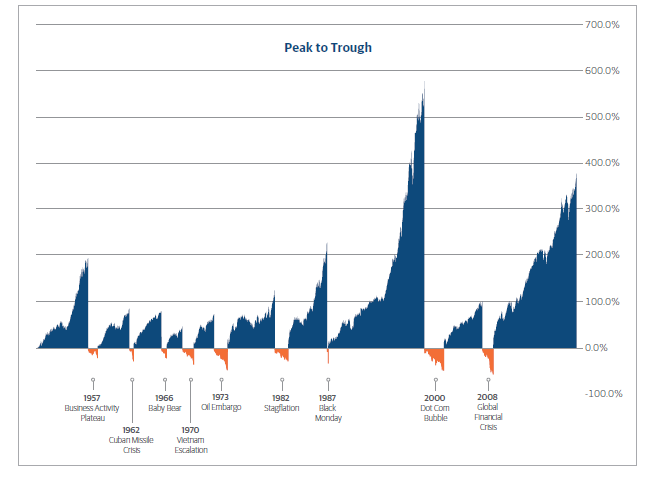

S&P 500 performance through expansions and contractions

Downside volatility can test the conviction of all investors. While the scale of down markets often feels enormous, stock market expansions historically have been longer and larger compared to contractions, highlighting the importance of staying invested through market cycles.