Its been a rocky start to the New Year on investment markets across the globe. The FTSE 100, (the measure of the largest UK shares) started off like a train and as that is the only index quoted in the news, everyone thought their investments would perform in the same way. Unfortunately, most investors don’t have a massive exposure to the UK as it has underperformed for many years. Most portfolios, over the last 4-5 years have had a larger exposure to the US and global markets and have done very nicely indeed.

What investors need at this moment in time is a little perspective and a little faith that investments in their pensions and other tax wrappers are long term investments and they should work out over time. Look at the following graphs of our most popular Balanced Portfolios that are all a 5 out of 10 on the MPA Risk Scale.

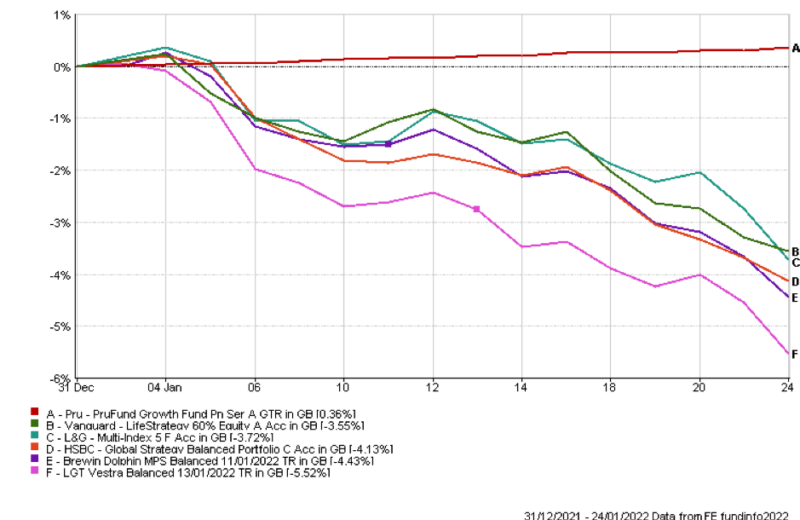

Fig 1 – Jan 1st 2022 to Jan 25th 2022

All the daily tradeable solutions have fallen between -3.55% and -5.52%. The only solution that has survived the sell off is the PruFund Growth which has a smoothing mechanism that does not go up and down in line with the vagaries of the markets and this is what we would expect in a none too extreme sell off.

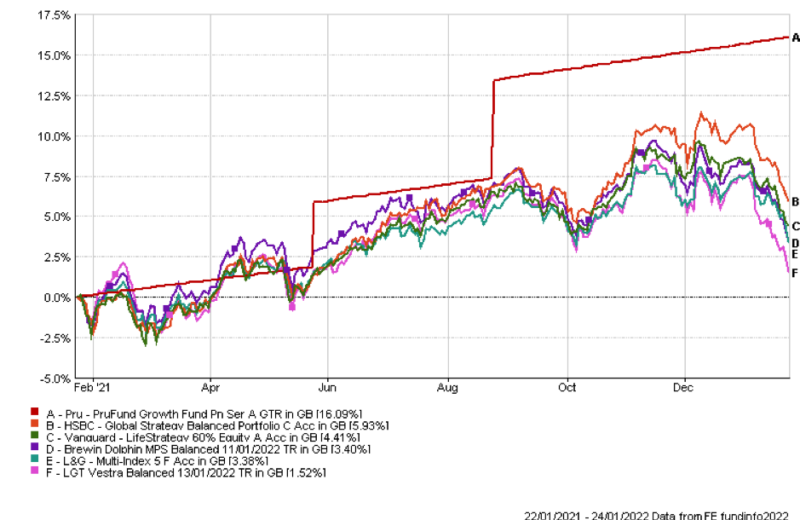

Fig 2 – Balanced Portfolios 1 Year

This chart shows the same portfolios over 1 year and the daily tradeable ones have all made a positive return from 5.93% to 1.52%. The PruFund has made an exceptional number but that is because it took time to recover form the crash of 2020.

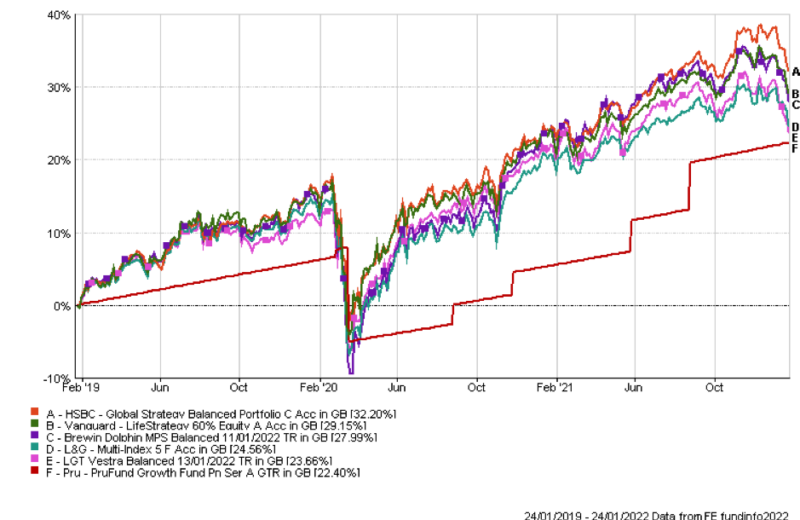

Fig 3 – Balanced Portfolios 3 Years

Over the medium term I would expect the above where the daily tradeable portfolios range from 29.15% to 23.61% and the PruFund is at 22.4%. All of them are exceeding expectations of 5% pa, which includes the recent sell off. So, patience and understanding is the order of the day.

HSBC has the highest allocation to the US and hence it has performed the best over 3 years.

What’s Causing the Jitters?

There are a number of issues in global markets affecting returns. There is inflation raging on both sides of the Atlantic with the US at 7%, a reduction in quantitative easing in America, the threat of conflict in Ukraine, the pound strengthening against the dollar and still the effects of COVID and supply chain issues.

The biggest short term threat would be Ukraine and how the West responds to any invasion although the bigger longer term issue would be inflation and Central Banks response to it. The only thing they tend to do is to increase interest rates and the market is betting on 3 to 4 increases in the US this year and 2 in the UK. Rising interest rates mean that fixed interest securities such as gilts and corporate bonds will generally lose value when interest rates go up.

So, my view is that you should hold tight, ride out the wobbles and if you have cash in your investments maybe look to buy when the prices are at a low point.

If you want to discuss any issue with your adviser I am sure they will be willing to help.

Phil J McGovern FPFS

Chartered Financial Planner

Please remember that investments and the income from them can fall as well as rise in line with market conditions and are not guaranteed. The above cannot be viewed as giving advice and is a general comment on the current markets by MPA FM Ltd. If you want individual advice that takes account of your specific requirements please call a qualified financial adviser.

25/01/2022