Dear Investor,

10 January 2020

THIS LETTER IS IMPORTANT – PLEASE READ

LF Equity Income Fund (formerly named LF Woodford Equity Income Fund) (the “Fund”), a sub-fund of LF Investment Fund (formerly named LF Woodford Investment Fund) (the “Company”).

We, Link Fund Solutions Limited (“LFS”), write further to our previous letter of 13 December 2019 to provide you with important information regarding the Fund, in particular, changes to the timetable for the first payment to investors.

You will be aware that because of a lack of certainty about how long it would take to reposition the Fund’s portfolio in a way that would enable the Fund to meet redemption requests by investors, we decided not to re-open the Fund following its suspension on 3 June 2019. We concluded that it was in the best interests of investors for the Fund to be wound up by way of an orderly realisation of the Fund’s assets to allow the return of money to investors through interim payments (“capital distributions”). Investors were advised of this decision in a letter dated 15 October 2019.

Please see below for an update to the timetable for the payment of your first capital distribution.

1. Winding up of the Fund

As we set out in our letter dated 13 December 2019, the FCA has provided its approval for the winding up of the Fund to commence on 18 January 2020. Therefore, the final valuation of the assets before the winding-up commences will occur on 17 January 2020. These dates are unchanged and, as previously advised, once we had taken the decision to wind up the Fund, this was the earliest possible date for the winding up to commence because of the requirement under a European Directive to give investors three months’ notice of our decision.

2. Capital Distribution to investors

In winding up the Fund, we will move to an orderly realisation of all its assets. After taking account of any liabilities that the Fund owes, including the costs associated with the winding up process and contingent commitments the Fund has in respect of its investments, we will begin paying you your share of the proceeds of the sale of the Fund’s assets.

In our previous letter, we said that we intended that investors in the Fund would receive their first payment on or around 20 January 2020. This date will now be on or around 30 January 2020.

This change to the timetable is required to ensure that investors retain exposure to the equity market for the entire period prior to the Fund being wound up as required by the regulations. This delay also allows a significant portion of the Fund’s holdings in money market instruments to be liquidated in a way that minimises costs to the Fund.

Please note that if you hold your investment through a fund platform you may receive your payment a few days after 30 January (or such other date on which the payment is made by us) due to the time it may take for your platform to process your payment.

As a result of the change to the date of the first capital distribution there will be two further changes to the timetable: (i) the calculation of the amount you will receive will now be made on 24 January 2020 (instead of 6 January); and (ii) we will write to you on or around 28 January 2020 to inform you of the amount you will receive as a result of this first capital distribution. That letter will also provide details of the costs associated with the transitioning of the portfolio prior to the winding up of the Fund and the expected costs of the winding up of the Fund. This letter was previously scheduled for 13 January 2020.

In our letters to you dated 15 October 2019 and 13 December 2019, both of which are available at equityincome.linkfundsolutions.co.uk, we explained how the Fund has been split into two portfolios (“A” and “B”) and BlackRock Advisors (UK) Limited’s (“BlackRock”) and PJT Partners (UK) Limited’s (“Park Hill”) respective roles in assisting us to sell the assets in each portfolio in a way that safeguards value in those assets rather than through a ‘fire sale’. This process continues (with the proceeds of sales before 17 January 2020 re-invested in FTSE 100 index instruments, money market funds, government securities and commercial paper with short maturity date to maintain the Fund’s exposure to the market). By way of update, since its appointment BlackRock has realised £1.9 billion, representing 90% of the value of Portfolio A and 63% of the value of the Fund and we continue to work with Park Hill to explore opportunities for the sale of assets within Portfolio B.

3. Distributions of income to investors

There will be no change to the dates of the income distribution attributable to the year ending 31 December 2019 (to be paid on 28 February 2020) or the distribution of income covering the period 1 January to 17 January 2020 (to be paid on 17 March 2020).

For further details on these income distributions, which will be paid in addition to the capital distribution on or around 30 January 2020, please see our letter dated 13 December 2019 which is available on our website: equityincome.linkfundsolutions.co.uk.

4. Timeline of significant dates

As noted above the process of returning amounts to you will commence in January 2020 and we have set out a reminder of all significant activities and their dates below. Events with a date that differs from the timeline provided in our letter of 13 December 2019 are in bold:

11 December 2019 – Company and Fund names changed to LF Investment Fund and LF Equity Income Fund respectively

31 December 2019 – Fund year end and normal quarterly Income Distribution date (XD date)

17 January 2020 – Pre-wind up price calculation and calculation of income distribution (see sections 3 and 4 above)

18 January 2020 – Fund wind up commences – effective date

24 January 2020 Calculation of amount per share to be paid in first capital distribution to investors

On or around 28 January 2020 – Notification to investors of amount per share to be paid in first capital distribution to investors

On or around 30 January 2020 – Expected date of first capital distribution to investors

28 February 2020 – Payment of normal quarterly Income Distribution as at 31 December 2019 (XD date)

17 March 2020 – Payment of the Income Distribution for the period 1 – 17 January 2020

30 April 2020 – Publication of Fund’s annual report for the year ending 31 December 2019

5. Performance of the Fund

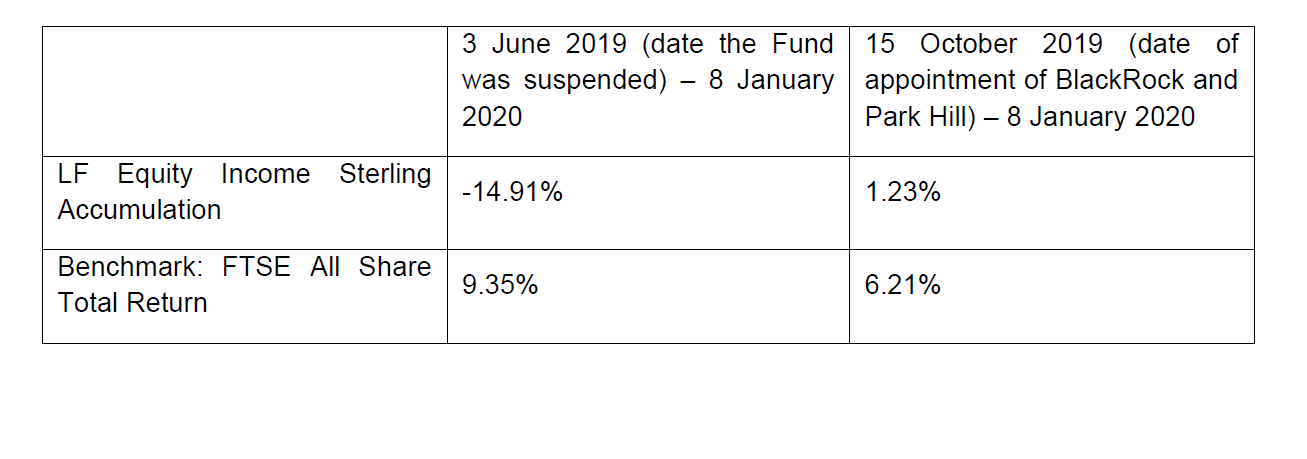

The table below shows the performance of the Fund versus the performance of the comparator benchmark, as set out in the Fund’s prospectus, for both the period since suspension and the period since the decision was taken to wind up the Fund and BlackRock and Park Hill were appointed, in each case to 8 January 2020.

The underperformance since the 15 October 2019 is largely attributable to the revaluation and disposal, by LFS in our capacity as the authorised corporate director, of certain unquoted assets in Portfolio B.

Until the winding up of the Fund is complete we will continue to calculate and publish the Net Asset Value per share on a regular basis for information purposes only (this will be on a daily basis until notified otherwise). This information, which allows investors to track the performance of their investment, can be found at equityincome.linkfundsolutions.co.uk.

6. Further information

We will write to you to keep you informed of developments throughout the winding up process, including the letter on or around 28 January 2020 in which we will provide an update on the winding up of the Fund and the amount that you will receive as the first capital distribution. In the meantime, if you do require any further information, please refer to the frequently asked questions and answers document on our website: equityincome.linkfundsolutions.co.uk.

If you have any questions regarding this letter, please contact us on 0333 300 0381 or alternatively email us at equityincome@linkgroup.co.uk.

Yours sincerely

Karl Midl

Managing Director – Link Fund Solutions Limited